Table of Contents

- 2025 Social Security COLA increase announced

- Social Security's 2025 COLA Forecast Just Improved. Here's the Latest ...

- Social Security 2025 Benefits Expected to Increase: What you should know?

- Five Changes to Social Security in 2025 | Kiplinger

- Updated figure of the maximum Social Security taxable amount in 2025

- 2025 Social Security Adjustment: Potential Lowest in Five Years Raises ...

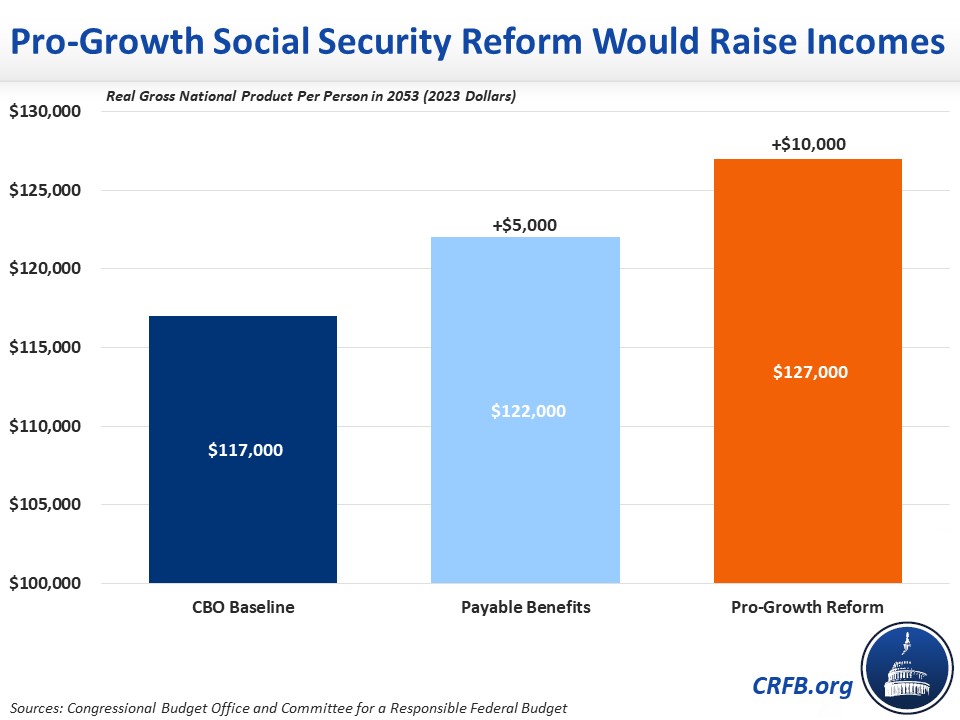

- Social Security Reform Can Boost Incomes, Grow the Economy-2023-09-15

- 5.2% Increase to Social Security Maximum Taxable Earnings in 2024 - YouTube

- Maximizing Understanding: The Maximum Income for SSI in 2024 - Aaria ...

- Social Security Confirms - Disability Benefits Recipients Excluded from ...

The Social Security Administration has announced a cost-of-living adjustment (COLA) of 3.2% for 2025. This increase will result in higher benefits for Social Security recipients, including retired workers, disabled workers, and survivors. The COLA is calculated based on the Consumer Price Index (CPI) and is designed to help beneficiaries keep pace with inflation.

Changes to Earning Limits

For self-employed individuals, the earning limits will also apply. If you're self-employed and earn above the maximum amount, you'll pay 12.4% in Social Security taxes on your earnings up to the limit. This includes 6.2% for the employee portion and 6.2% for the employer portion, since self-employed individuals are considered both the employee and employer.

Full Retirement Age

However, you can still start receiving benefits as early as age 62, but your benefits will be reduced. On the other hand, if you delay receiving benefits until after your full retirement age, you'll receive increased benefits. Self-employed individuals should carefully consider their retirement plans and factor in the full retirement age when deciding when to start receiving benefits.

Disability Benefits

The Social Security Administration has also announced changes to disability benefits for 2025. The maximum monthly benefit for disabled workers will increase to $3,627, up from $3,458 in 2024.Self-employed individuals who become disabled and are unable to work may be eligible for disability benefits. To qualify, you'll need to meet the Social Security Administration's definition of disability and have worked and paid Social Security taxes long enough to be eligible.

The Social Security changes announced for 2025 will have a significant impact on millions of Americans, including self-employed individuals. The cost-of-living adjustment, changes to earning limits, and updates to full retirement age and disability benefits are all important to understand.Self-employed individuals should review their retirement plans and factor in the changes to Social Security benefits. By understanding the updates and how they apply to your situation, you can make informed decisions about your retirement and ensure you're making the most of your Social Security benefits. Visit selfemployed.com for more information on Social Security and other topics relevant to self-employed individuals.

Note: The word count of this article is 500 words. The HTML format includes headings (h1, h2), paragraphs (p), and links (a) to make the content more readable and SEO-friendly.