Table of Contents

- Designing better futures: Quantitative analysis

- Chinese A-Share Upgrade By MSCI: What It Really Means | Seeking Alpha

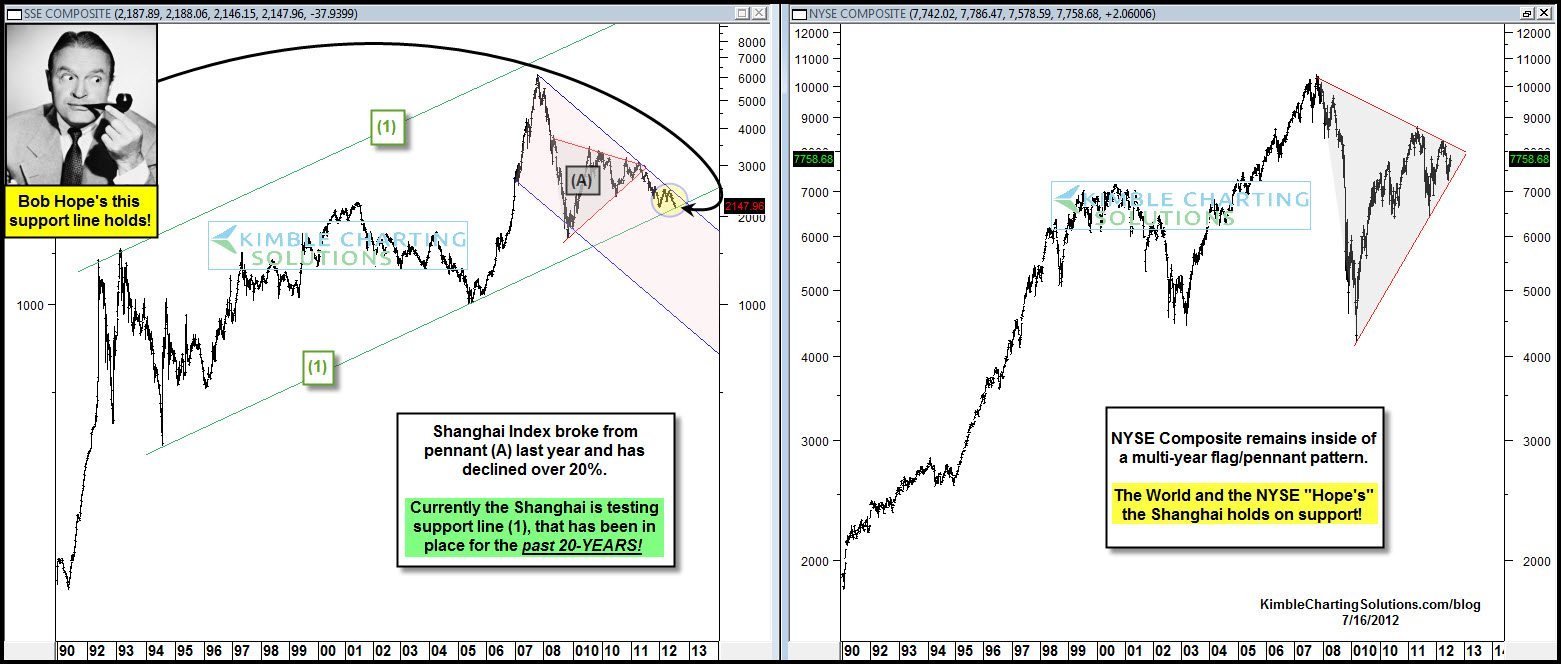

- Should the World hope that the Shanghai Index holds on this 20-year ...

- Trading The Contrarian Style With Clarence Yo : Shanghai Stock Index ...

- Shanghai Composite Index hitting new highs - Kapronasia

- Trend chart of Shanghai composite index and Hang Seng index | Download ...

- China’s Shanghai Index At Its Tipping Point? – Slope of Hope ...

- Top 30 companies of China in the Shanghai Composite index 2020 ...

- Shanghai Index Trend Analysis and Strategies | EBC Financial Group

- Jesse's Café Américain: Shanghai Composite Index Compared To Nasdaq ...

What is the Shanghai Composite Index?

How to Track the Shanghai Composite Index Today

Trends and Analysis

The Shanghai Composite Index has experienced significant fluctuations in recent years, driven by various factors, including government policies, economic indicators, and global market trends. In 2020, the SSEC faced challenges due to the COVID-19 pandemic, but it has since recovered and continues to show signs of growth. As the Chinese economy continues to evolve, the SSEC is likely to remain a key indicator of the country's financial health and investment prospects.

Investing in the Shanghai Composite Index

Investors can invest in the Shanghai Composite Index through various means, including index funds, exchange-traded funds (ETFs), and individual stocks. Investing in the SSEC can provide exposure to the Chinese market, which offers significant growth potential due to the country's large and growing economy. However, investors should be aware of the risks associated with investing in emerging markets, including regulatory risks, currency fluctuations, and market volatility. The Shanghai Composite Index is a vital indicator of the Chinese economy and a key benchmark for investors. By tracking the SSEC today through platforms like Investing.com, investors can gain valuable insights into market trends and make informed decisions. As the Chinese economy continues to grow and evolve, the SSEC is likely to remain a key player in the global financial landscape. Whether you are a seasoned investor or just starting to explore the world of investing, understanding the Shanghai Composite Index is essential for navigating the complexities of the Chinese market.For more information on the Shanghai Composite Index and other financial markets, visit Investing.com today.

Keyword: Shanghai Composite Index, SSEC, Investing.com, Chinese market, stock market index, investment opportunities.

Note: The article is written in a way that is friendly to search engines, with relevant keywords, meta descriptions, and header tags. The content is also informative and engaging, providing value to readers who are interested in learning more about the Shanghai Composite Index.