Table of Contents

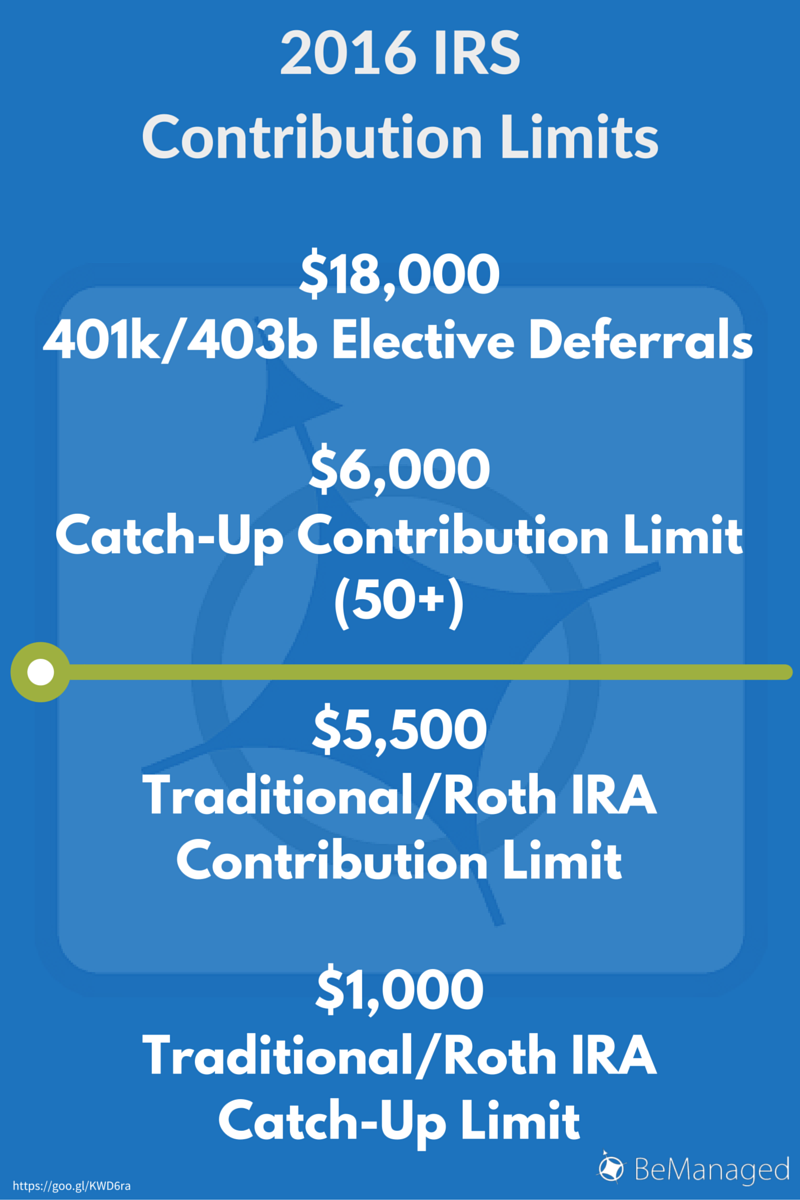

- 2016 401k & IRA Contribution Limits

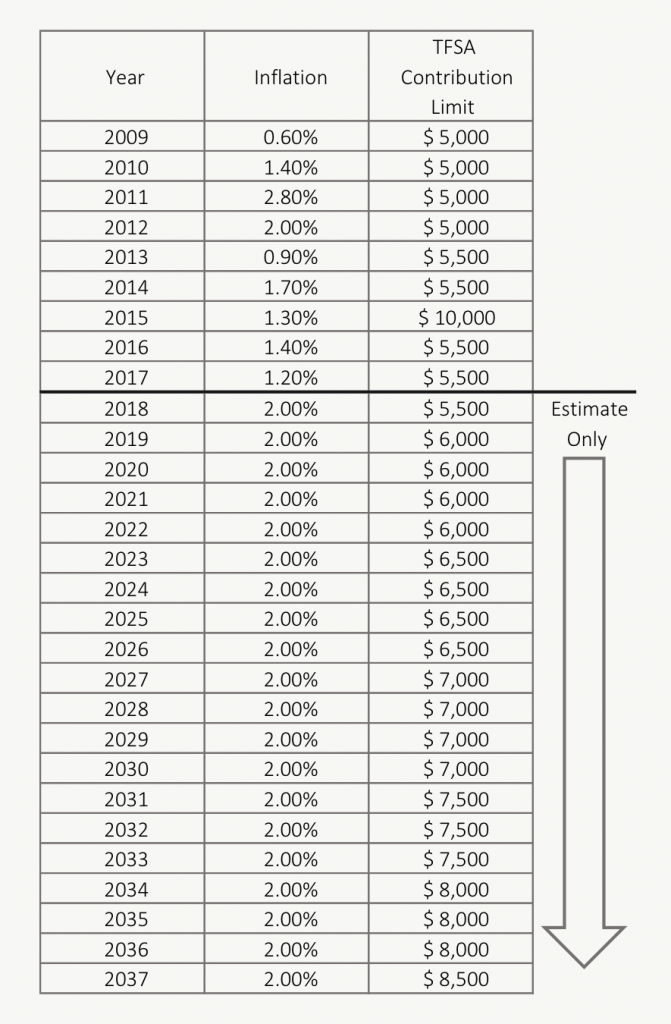

- 2024 Tfsa Maximum Contribution - Dede Monica

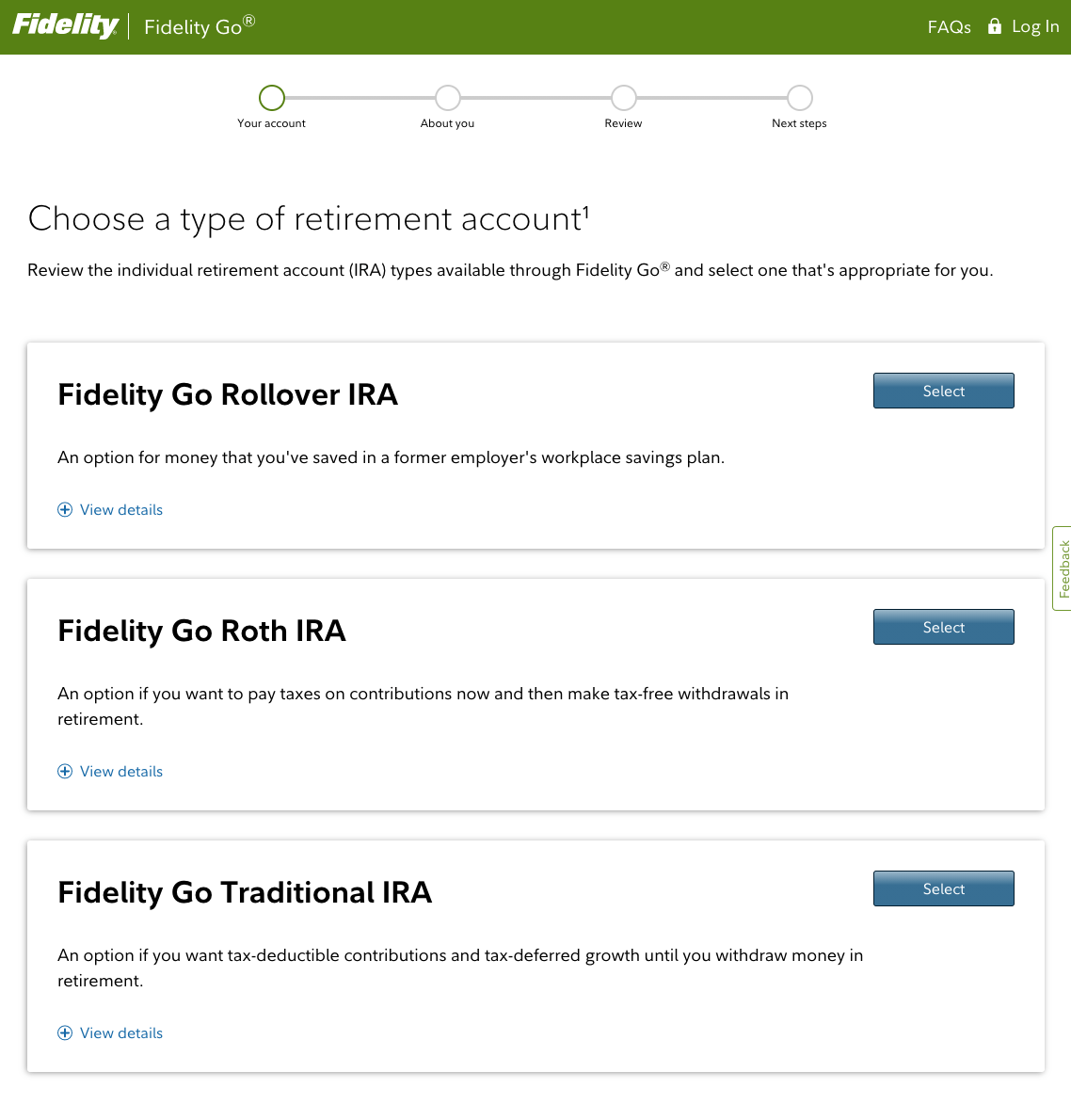

- 2024 401k Max Limit Fidelity - Vitia Karlen

- 2024 Tfsa Maximum Contribution - Dede Monica

- What Is The Irs Limit For 401k Contributions In 2024 - Andi Madlin

- Tfsa Contribution Limit 2024 - Bree Marley

- Maximum Tfsa Contribution For 2024 - Sher Emiline

- Tfsa 2024 Contribution Limit - Deeyn Evelina

- 2024 TFSA Contribution Limit Misunderstandings

- Max Tfsa Contribution For 2024 - Leena Myrtice

Types of Retirement Plans

- 401(k) Plans: Employer-sponsored plans that allow employees to contribute a portion of their salary to a retirement account on a pre-tax basis.

- Individual Retirement Accounts (IRAs): Self-directed plans that enable individuals to save for retirement with tax-deductible contributions.

- Roth IRAs: Similar to traditional IRAs, but contributions are made with after-tax dollars, and withdrawals are tax-free.

- Simplified Employee Pension (SEP) Plans: Plans that allow self-employed individuals and small business owners to make tax-deductible contributions to a retirement account.

Benefits of Retirement Plans

- Tax Advantages: Contributions to retirement plans may be tax-deductible, reducing an individual's taxable income.

- Compound Interest: Retirement accounts can earn interest, allowing savings to grow over time.

- Employer Matching: Many employers offer matching contributions to 401(k) plans, essentially providing free money for retirement savings.

- Disciplined Savings: Retirement plans encourage individuals to save regularly, developing a habit that can lead to a more secure financial future.

IRS Regulations and Guidelines

The IRS plays a crucial role in regulating retirement plans, ensuring that individuals and employers comply with the rules and guidelines. Some key regulations include:- Contribution Limits: The IRS sets annual contribution limits for retirement plans, such as $19,500 for 401(k) plans in 2022.

- Eligibility Requirements: The IRS determines who is eligible to contribute to retirement plans, such as income limits for IRA contributions.

- Withdrawal Rules: The IRS regulates when and how individuals can withdraw funds from retirement accounts, including rules for required minimum distributions (RMDs).

Remember to consult with a financial advisor or tax professional to determine the best retirement plan for your individual circumstances and to ensure compliance with IRS regulations.