Table of Contents

- Social Security Income Limit 2024 Age 62 - Nicki Amabelle

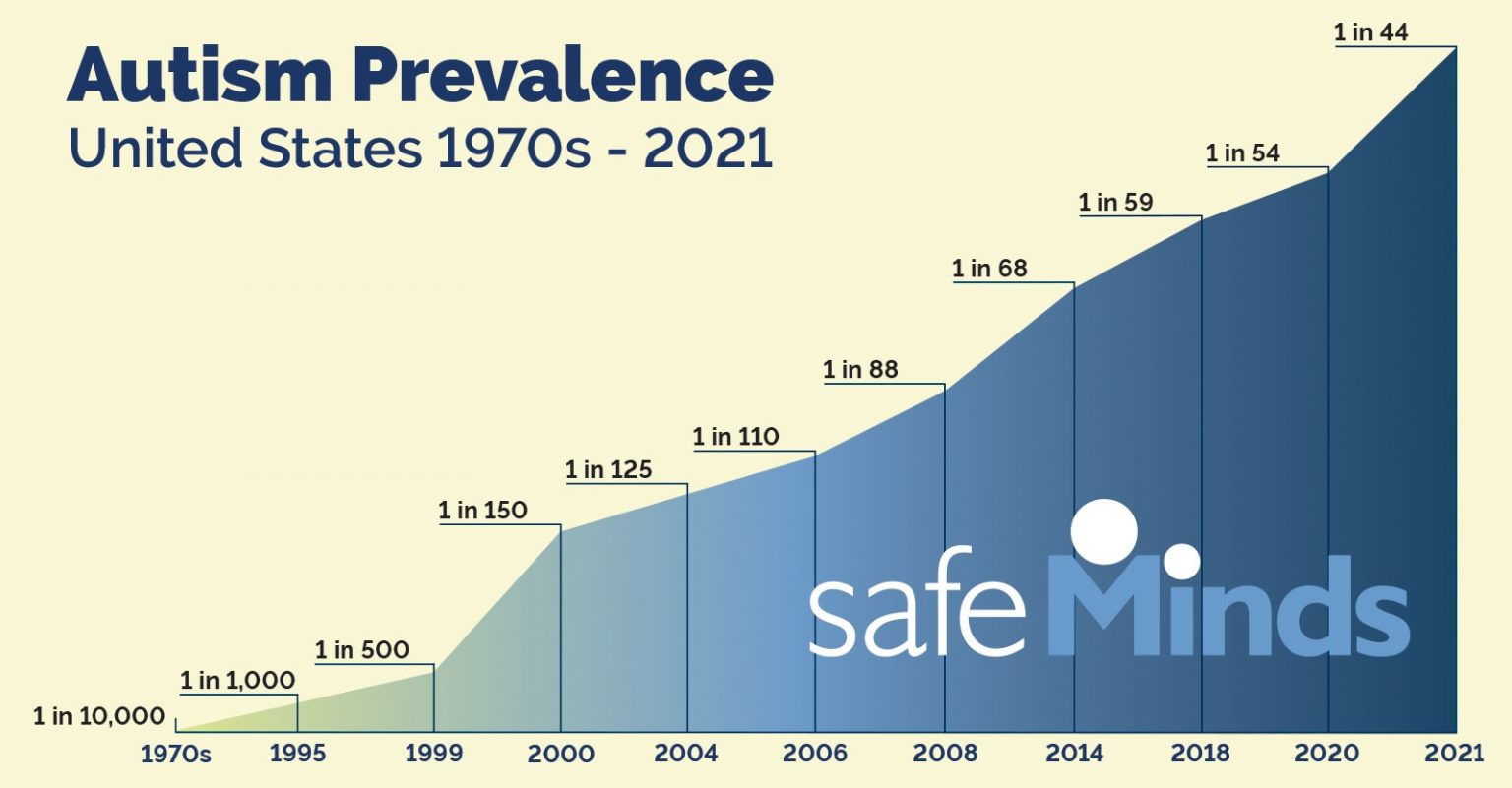

- Supplemental Security Income Increases in 2022 - SafeMinds

- 2024 Social Security Increase Percentage - Cody Mercie

- Earnings limit for 2024 : r/SocialSecurity

- What Is The Maximum Social Security Withholding For 2025 - Alfy Louisa

- Seniors get slight boost for 2024 Social Security checks | Fox Business

- What is the 2024 Social Security COLA Adjustment? - AskMyAdviser

- 2025 Social Security Adjustment: Potential Lowest in Five Years Raises ...

- 5.2% Increase to Social Security Maximum Taxable Earnings in 2024 - YouTube

- Social Security Max Income Allowed 2024 Married - Katie Christiane

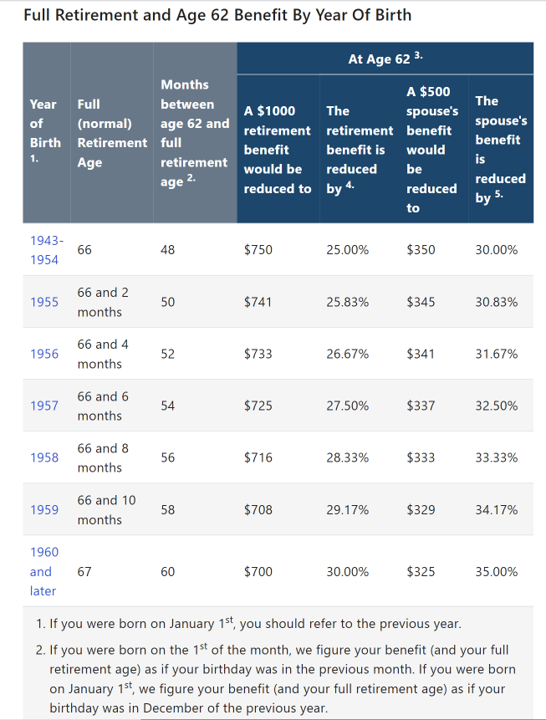

1. Increased Full Retirement Age

For example, if the full retirement age is increased to 68, individuals who claim their benefits at 62 would see a reduction in their monthly payments. On the other hand, those who delay claiming their benefits until 70 or later could see an increase in their payments. It's crucial to review your retirement plans and consider how an increased full retirement age might impact your benefits.

2. Changes to the Cost-of-Living Adjustment (COLA)

A revised COLA formula would help ensure that Social Security benefits keep pace with the actual costs faced by retirees, providing them with a more stable and secure income stream. This change would be particularly beneficial for seniors who rely heavily on their Social Security benefits to cover living expenses.

3. Expansion of Social Security Benefits for Certain Groups

Finally, there's a possibility that 2026 could see an expansion of Social Security benefits for certain groups, such as caregivers and students. For instance, lawmakers might consider providing benefits to caregivers who take time off work to care for a family member, or to students who are pursuing higher education. This expansion would help recognize the valuable contributions made by these individuals and provide them with greater financial security.An expansion of benefits would not only help support these groups but also contribute to the overall sustainability of the Social Security system. By providing benefits to a broader range of individuals, the system can tap into a larger pool of contributors, helping to ensure its long-term viability.

As we look ahead to 2026, it's clear that there are several significant Social Security changes on the horizon. From an increased full retirement age to changes in the COLA formula and an expansion of benefits for certain groups, these reforms have the potential to impact millions of Americans. By staying informed and planning ahead, you can navigate these changes and ensure that you're making the most of your Social Security benefits.Remember to review your retirement plans regularly and consider consulting with a financial advisor to determine how these potential changes might affect your individual circumstances. With the right information and planning, you can secure a more stable and secure financial future.